Impact of GST on Two wheelers and Bikes in India

Last Modified: 3-December-2024

The government of India brought the Goods and Services Tax (GST) to unify the various indirect tax rates applicable in the country. It brings 17 central and state taxes under a single tax umbrella. Like several other sectors, the two-wheeler loan segments have also seen an impact of GST. When getting a two-wheeler loan, use an EMI calculator to calculate the EMI amount before loan application. Let’s learn how much GST has impacted the cost of two-wheeler and two-wheeler loans.

Impact of GST on Bike Purchases

The vehicle’s engine capacity affects the GST percentage on purchasing a bike or two-wheeler. The higher the engine capacity of a bike, the more the applicable GST is on it. In other words, the more premium bikes attract a higher level of GST than the basic versions.

Here in this table there is all the information you need to know about the impact of GST on bikes in the country.

Current Bike GST Rates for 2024

| Category | GST Rate |

| Two wheelers with an Engine Capacity of over 350cc | 31% |

| Two wheelers with Engine Capacity below 350cc | 28% |

| Two-wheeler insurance policy | 18% |

| Clutch Cable, Gauge Oil Level, and Brake Pads | 28% |

| Battery Charging, Consumables, and Lubricants | 18% |

Earlier, multiple taxes were levied on the central and state levels, but after the implementation of GST, all these taxes were combined into one.

GST on Two wheelers in India

The implementation of GST in 2017 reduced the tax burden on two wheelers in the country. Many bike manufacturers passed on the tax benefits to the customers through price discounts on several bike models. It encouraged more and more people to purchase their two wheelers and enjoy the freedom of safe commuting. When planning to purchase a two-wheeler with a two-wheeler loan, find out the EMI applicable on your two-wheeler using the two wheeler loan EMI calculator present online.

GST on Purchase of Electric Bikes

Electric vehicles are the new trends in the automobile industry, and electric bikes and scooters are taking the two-wheeler segment by storm. The soaring gas and petrol prices and the increasing environmental conservation awareness motivate more and more people to opt for electric bikes. Based on this trend, bike manufacturers encourage bike enthusiasts to purchase electric bikes. To support this, the GST applicable on electrical two wheelers is only 5%. Since electric bikes and scooters are in the inception stage in the country, the low GST on electric vehicles encourages their sale and purchase across the country.

Earlier, the GST applicable on electric vehicles was 12%. With the considerable drop in the GST on these vehicles, their price has significantly reduced, allowing more people to experience the comfort and convenience of electric bikes. Since electric vehicles have vast potential in the country, the decreased prices are expected to add more value to their sales in the coming times.

GST on Insurance Policy of Two wheelers

As per the prevailing taxation norms in India, the GST on two-wheeler and bike insurance policies is applicable at a base rate of 18%. It means the insurance policyholder needs to pay a GST of 18% on the insurance policy premium. Before GST, the two-wheeler insurance policies’ total taxes were up to 15%. Hence, the GST applicable on third-party and comprehensive bike insurance has effectively increased.

GST Benefits for Two-Wheeler Buyers

Buying a two-wheeler in India comes with several benefits under GST. Here’s how GST makes a difference:

1. Simplified Taxes

GST has replaced multiple taxes with one unified tax, making it easier for buyers to understand how much tax they are paying.

2. Fair Pricing Across India

Earlier, two-wheeler prices varied between states due to different taxes. With GST, prices are more uniform, so you pay a similar amount no matter where you buy.

3. Lower Taxes on Electric Vehicles

Electric two-wheelers enjoy lower GST rates and additional government incentives, making them more affordable and eco-friendly.

GST Impact on Top 10 Indian Bikes Prices

The following are some popular vehicles with their displacements and how the rates have changed based on the new GST rate.

1. Hero HF Deluxe

Prior to GST introduction, the ex-showroom price of Hero HF Deluxe was approximately INR 42,000 in Delhi. The displacement is 97 cc. The bike GST rate has now been reduced by 3% to 5%. As the GST came into effect, the new ex-showroom price of the two-wheeler was approximately INR 41,000.

2. Hero Splendor

Hero Splendor has always been one of the most desired bikes in India as this bike falls into the affordable category. The ex-showroom price of the bike before GST was approx. INR 48,000 in Delhi. As the displacement of this bike is 97.2 cc, the price has been reduced to 3% to 5% and after GST it came to approx. INR 46,000.

3. Hero Glamour

The displacement of the Hero Glamour is 124.7 cc and the ex-showroom price in Delhi before GST was approx. INR 56,000. After GST, the price was reduced to approx. INR 54,000.

4. Hero Passion

Before GST implementation, the ex-showroom price of this bike was approx. INR 52,000 in the capital city of the country. The engine capacity of the bike is 97 cc. The ex-showroom price of the bike after GST came down to approx. INR 49,000.

5. Honda Dream Yuga

Displacement of the Honda Dream Yuga is 124.7 cc, and the ex-showroom price of this bike was approx. INR 51,000 before GST came down. The price of this bike became approx. INR 50,000 after GST was introduced.

6. Honda CB Shine

Engine capacity of this bike is 124.7cc and its price used to be approx. INR 56,000 before GST. Post GST, the ex-showroom price of the bike was revised and it became approximately INR 53,000.

7. Bajaj Platina

This bike comes with 100cc displacement. The ex-showroom price of the bike used to be approx. INR 45,000 before GST came into effect. After GST, the ex-showroom price was reduced to 3% to 5% and became approx. INR 44,000.

8. Honda CB Unicorn 150

The engine capacity of this bike is 149 cc and the ex-showroom price used to be approx INR 70,000 pre-GST. After GST, the price became approx. INR 68,000.

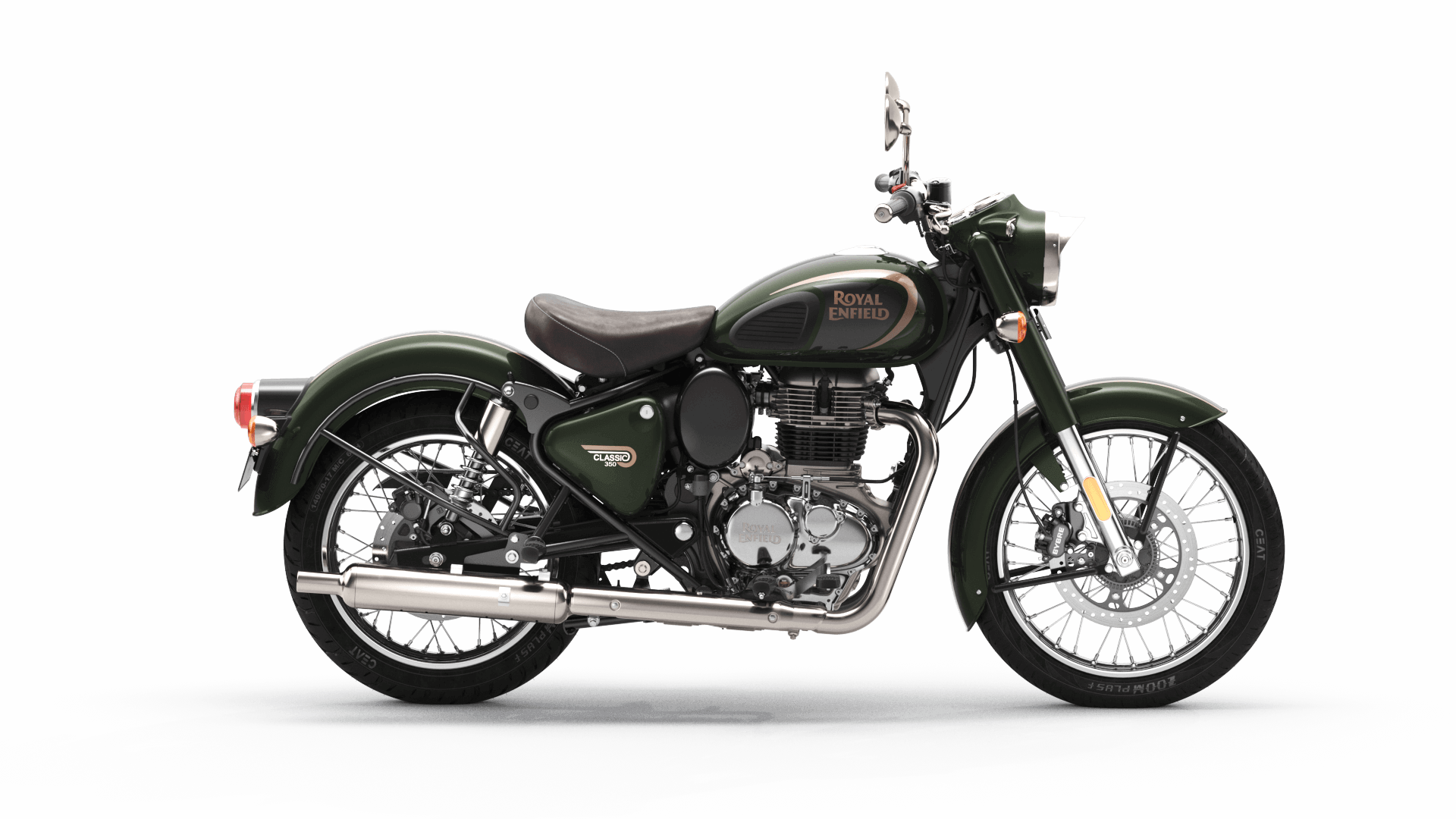

9. Royal Enfield Classic 350

The displacement of this bike is 346 cc. Before GST came down, the ex-showroom price was approx. INR 1,35,000. After GST, the ex-showroom price was Approx. INR 1,30,000.

10. Bajaj Pulsar

Bajaj Pulsar has displacement of 220 cc, the ex-showroom price of this bike used to be approx. INR 92,000. After GST, the ex-showroom price became around INR 88,000.

Things to Keep in Mind When Buying a Two-Wheeler

Before buying a two-wheeler, here are some important points about GST and other taxes to consider:

1. Check the GST Rate

The GST rate depends on the type of two-wheeler. Smaller engine bikes and electric scooters usually have lower GST rates compared to bigger bikes.

2. Electric vs Regular Two-Wheelers

If you’re considering an electric two-wheeler, you’ll benefit from lower GST and other incentives, reducing your overall cost.

3. Additional State Taxes

Apart from GST, some states may add extra taxes or charges. Always ask your dealer about the total cost, including state-specific taxes.

4. Proper Documentation

Ensure you complete all the paperwork, like insurance, and meet all legal requirements during the purchase to avoid issues later.

Conclusion

A further reduction in the GST applicable on bikes and two wheelers is on the cards, and bike manufacturers and sellers eagerly await the move. A reduction in the GST applicable on two wheelers will lead to a further reduction in the price of bikes in the country. Once customers decide on a two-wheeler, they can get a loan to finance the purchase. To calculate the EMI applicable on a two-wheeler loan, an individual can use an online two-wheeler loan EMI calculator available on the lender’s website.

FAQS

What is the GST rate for an electric vehicle?

The GST rate on electric vehicles has been reduced from 12% to 5%. For chargers and charging stations, the GST rate is also 5%, making electric vehicles more affordable.

How to claim GST over bikes?

You can claim GST on bikes if:

- The bike is bought for resale.

- It is used for passenger transport services.

- It is used in a driving schools.

Can ITC be claimed on the GST that is paid to purchase a two-wheeler?

No, you cannot claim Input Tax Credit (ITC) on GST paid for buying a two-wheeler.

What was the tax rate earlier on two-wheelers that are below 350 cc?

Earlier, two-wheelers with an engine capacity below 350 cc were taxed at 30%.

Trending Post

- Complete Guide To Bike Loan Eligibility Criteria

- Easy Loan Options For Purchasing Your Dream Bike

- Key Features Of Two-Wheeler Loans That Make Life Easier

- Guide To Finding The Lower Rate Two-Wheeler Loan

Categories

Need Help?

Please feel free to contact us on toll free number or send us your query on our email.